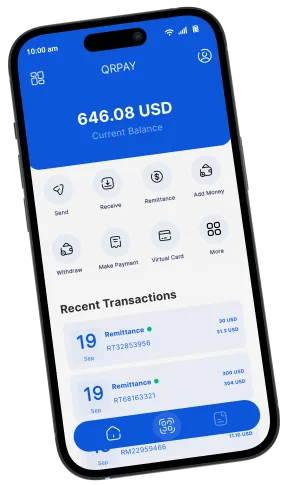

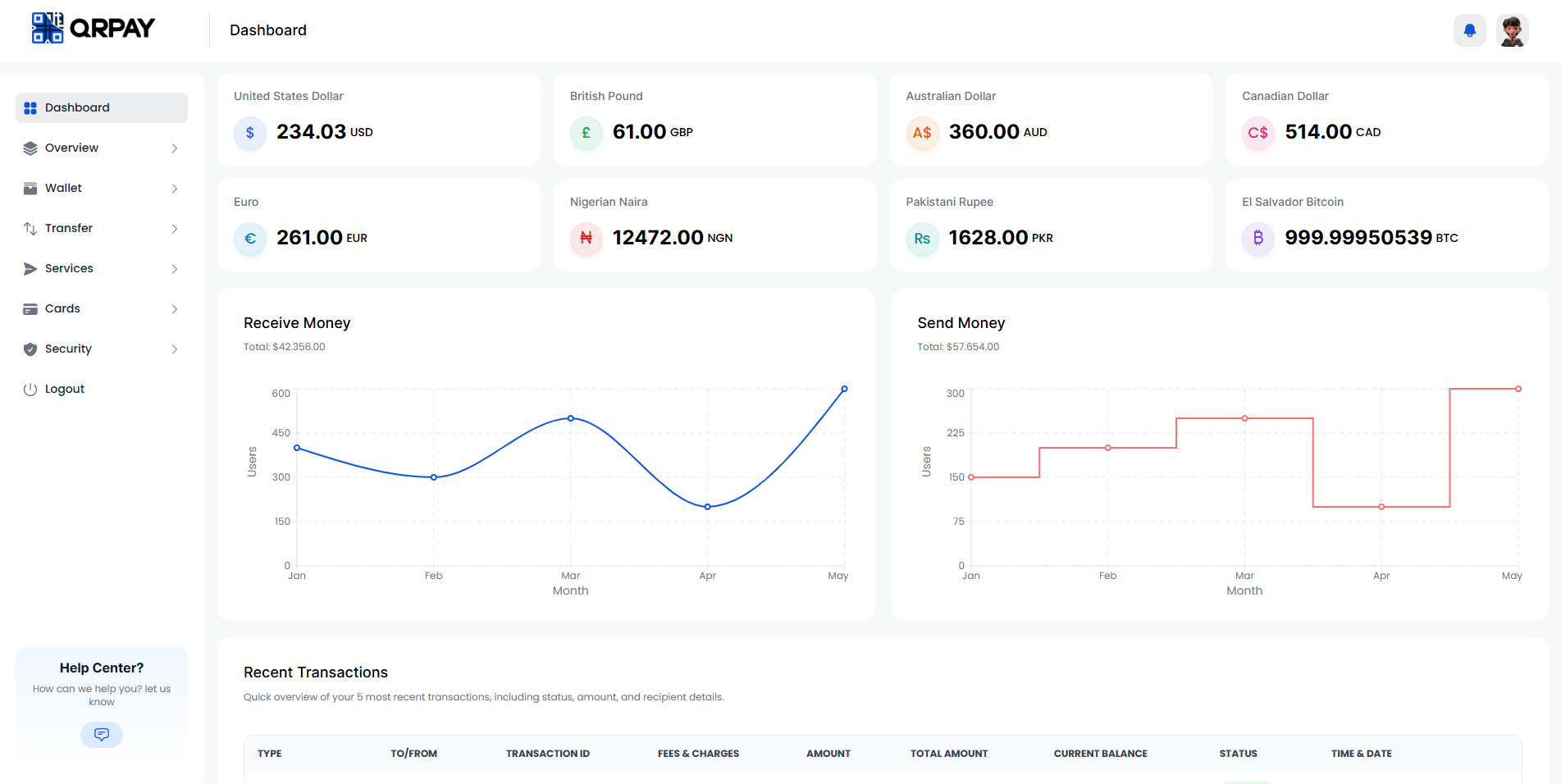

Launch your own white-label mobile banking app and website with multi-currency wallets, virtual cards, payment links, and more — without building from scratch.

Offer fast, secure international money transfers. Manage recipients, track transactions, and serve customers with a robust user and agent dashboard.

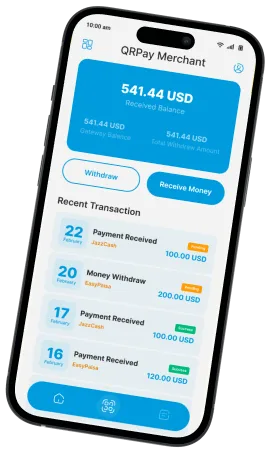

Accept payments via email, QR code, or custom payment links. Use our powerful merchant panel and developer API to integrate payments on your website or store.

Turn your business into a digital cash-in/cash-out hub with agent-based deposits, withdrawals, and money exchange features. Enable walk-in clients to use mobile financial services.

Client Type: Fintech startup in Africa

Use Case: They launched a fully-branded digital bank offering virtual cards, wallet-to-wallet transfers, and bill payment—all hosted on their own domain using QRPay's white-label solution.

Web panels + Android/iOS apps + Super Admin

25,000+ users onboarded in 4 months

Client Type: Remittance agent in the Middle East

Use Case: Agents used QRPay Cloud to handle remittance distribution via their custom app. Customers send money to recipients in rural areas via agents who cash out locally.

Agent Panel + Remittance + Withdraw APIs

Seamless money transfer for underserved regions

Client Type: Online marketplace

Use Case: They integrated QRPay's Developer API and enabled their vendors to accept payments via Stripe, PayPal, Flutterwave, or Wallet — without needing to build their own gateway.

Merchant Panel + Developer API + Payment Links

30% increase in payment completion rate

Client Type: Telecom retailer chain

Use Case: Retail stores transformed into mini-financial hubs. Agents could top-up user wallets, withdraw cash, pay bills, and sell gift cards using the QRPay Agent app.

Agent App + Transaction Logs + Profit Logs

Expanded from 5 to 40 branches in 6 months

QRPay-SaaS helped us launch our own neobank within days. The setup was smooth, and the features are enterprise-grade.

— Alex Morgan, Co-Founder @ SwiftBank (Fintech Startup)

We onboarded over 200 users and agents in under a week. The multi-currency, 2FA, and KYC features are game-changers.

— Fatima Zia, Merchant Operator, Pakistan

From integration to white-label deployment, their support was 10/10. I’ve never felt more confident scaling

— Carlos Mendez, Remittance Agent, Spain

We were looking to build a payment gateway — QRPay-SaaS gave us everything out of the box: APIs, merchant panel, mobile apps, and admin control.

— Linda Chen, CTO @ FinChain Africa

We chose QRPay-SaaS because it had everything we needed: mobile apps, web portals, and admin control. We launched our branded solution in 5 days!

— Noah J., CEO at NovaPay (Fintech Startup, UAE)

I manage over 30 agents with QRPay. Money exchange, remittance, mobile top-up — everything works flawlessly.

— Sylvia Otieno, Remittance Agent, Kenya

Our customers love the UI of the user app. Plus, we can manage currencies, customize text, and change branding — all from one place.

— Rahul Kumar, Tech Lead, FinCore India

As a merchant, I needed something that supports PayPal, Stripe, and local wallets — QRPay-SaaS nailed it.

— Emma B., E-commerce Merchant, UK

We got a fully white-labeled system — with our logo, colors, and apps — delivered in under a week.

— Mohammad Yasin, Founder @ QikWallet (Bangladesh)

QRPay-SaaS is a complete mobile banking solution that provides businesses with web and mobile apps to offer digital financial services. It includes multi-currency support, payment processing, remittance, and more.

QRPay-SaaS is ideal for fintech startups, digital banks, financial service providers, and businesses looking to offer e-wallet solutions with minimal development time.

No, QRPay-SaaS is designed to be user-friendly. We handle the setup and deployment, so you can focus on running your business.

Yes! We offer a limited trial period so you can explore the platform before committing to a plan.

Absolutely! You can upgrade or downgrade your plan anytime based on your business needs.

No, our pricing is transparent. You only pay for your selected plan, with no extra maintenance or setup charges.

QRPay-SaaS supports multiple gateways, including PayPal, Stripe, Flutterwave, JazzCash, UPI, PhonePe, and Bitcoin.

Yes! The Enterprise Plan allows full white-label branding, custom domains, and API integration.

Yes, QRPay-SaaS supports multi-currency transactions, allowing users to send, receive, and exchange money globally.

Yes, we provide built-in KYC verification to ensure compliance and user security.

Yes, we use end-to-end encryption, 2FA security, fraud prevention, and KYC compliance to ensure a safe transaction environment.

User, agent, merchant, super admin panel and database are hosted securely on our cloud.

Deployment typically takes 24-48 hours after your purchase and setup, depending on your requirements.

We offer 24/7 customer support via email, live chat, and a dedicated account manager for enterprise clients.

Can’t find what you’re looking for? Our team is ready to assist! Contact us for more information.